Controlled Foreign Corporations (CFC’s)

U.S. Citizens and Lawful Permanent Residents (i.e. Green Card holders) have unique income tax obligations, regardless of their country of residence, they must file United States income tax returns and international information returns annually. The U.S. income tax system is based on citizenship and lawful permanent resident status not just on residency, which differentiates it from most other global tax systems.

At Tax Partners, we strive to keep you informed of all new “Stateside” regulations that may affect U.S. Expatriates.

Earning Passive or Personal Services Income Through a Foreign Corporation?

Any US person (including someone who becomes a US person during the year) must include in current taxable personal income on his 1040, his distributive share of Subpart F income earned by a foreign controlled corporation during the year (subject to some deductions for qualifying deficits).

Subpart F income includes income of the foreign corporation which relates to passive activities like rents, interest and dividends (unless part of active business) illegal payments, bribes, etc., services rendered outside the foreign country, foreign personal holding company income, sales commissions earned for sales outside of the foreign country, etc. as defined below.

Subpart F income does not include active business income from operation of a business in the foreign country.

The thrust is to include in US personal taxable income passive income of US persons that has been channeled through a foreign country. Therefore, a Canadian who goes to the US to work providing personal services in the US through a Canadian corporation he controls, and becomes a US person by virtue of residence, would be liable to include all net personal service income in his US return which is earned by the Canadian corporation.

In general, the objective of internal revenue code section 951 is to prevent the accumulation of contact income in a foreign corporation when that income is earned by a U.S. person.

A Canadian working in United States may become a U.S. person by virtue of meeting the substantial presence test, or otherwise by meeting the requirements of U.S. residence. Although internal revenue code section 951 does not require the inclusion in United States income amounts earned by a corporation engaged in an active business or personal services business wholly within a foreign country [Canada], the inclusion does apply in cases where services income is earned by the Corporation in a country other than that in which it was incorporated [United States].

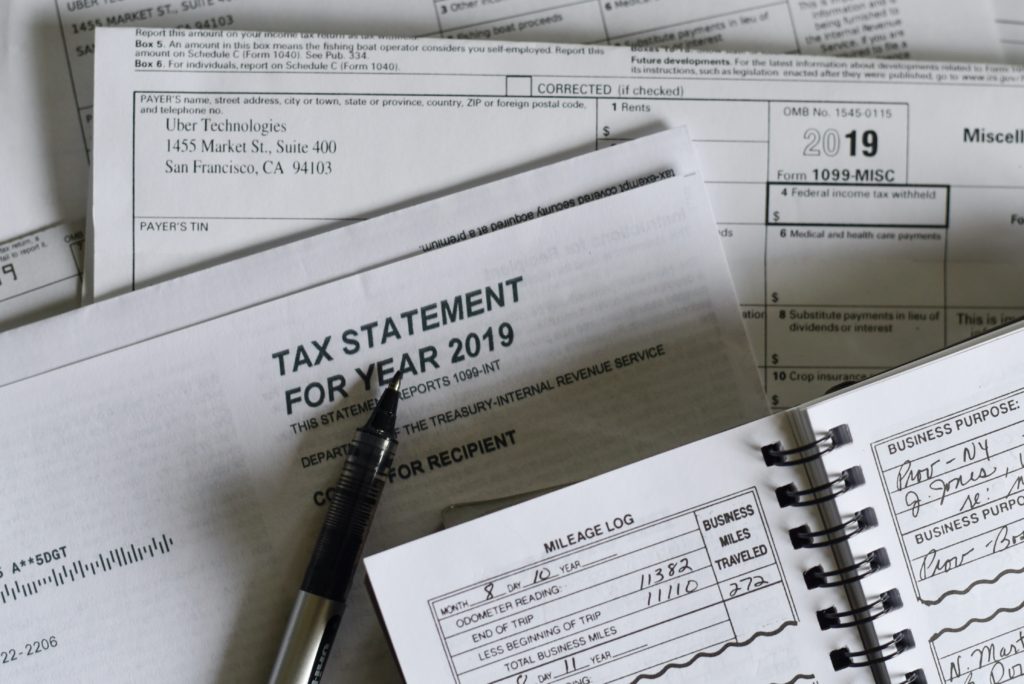

In order to disclose all relevant information related to a Canadian Corporation, form 5471 must be filed each year with the individuals form 1040 individual income tax return. Form 5471 requires a comprehensive line by line reporting of all transactions that have occurred within the foreign corporation during its last fiscal year.

This means that a detailed report about balance sheet items, income statement items, and transactions with shareholders must be reported on a multi-page form, both in United States dollars and foreign currency.

If you are engaged in providing personal services through your own Canadian Corporation, while you are residence of United States, please ensure that you advise us in order that we may prepare the appropriate form 5471 components with your tax return.